It’s important for investors to keep track on the repercussions of the UK’s exit from the European Union — except what will those be?

One bright shining spot in the British economy has been its leading edge biotech and pharmaceutical industry, powered by the oldest and best universities on the planet, a tradition of charitable foundations willing to fund research and development in biology and the hard sciences, and an efficient, rational and deliberate economic approach to paying for the healthcare of all of its citizens.

Let’s take one example, Oxford Biomedica, a small cap publicly traded UK based biotech that is on the frontier of genetic therapy. Way back in 1996, the company was spun out of Oxford University.

In 2003 an interview with its CEO at the time reveals the value of functioning capital markets willing to back risk taking entrepreneurs:

“We went pretty much straight to the public markets in London at that time. There was a new market called the Alternative Investment Market.

We went on to that, raised some initial funds in 1996 and then between 1996 and 2001, raised various amounts of money on the public markets, culminating in the spring of 2001 when we raised 35 million and moved to the main list of the London Stock Exchange. So overall we’ve taken about 65 million, $95 million out of the public markets.”

Of course, investors in the company in 2003 probably did not expect a 16 year wait for a product to hit the market, not to mention those investors who bought at the IPO in 1996.

However, now the company has a product, produced in coordination with Novartis, that is approved in the US, the EU and in Japan.

This product is a cure for children with advanced cancer that has resisted all treatment options.

In the words of its current CFO, Stuart Paynter:

“Kymriah, the Novartis product for pediatric acute lymphoblastic lymphoma that is also now approved for diffuse large B-cell lymphoma — DLBCL — is cleared by regulators in the U.S. and EU. It has been approved by the EMA — European Medicines Agency — and is going through the process to launch in 27 EU member states.

There are only three gene therapies marketed in the world at the moment, and this is one of them.”

Oxford Biomedica has the patent for the novel fashion for delivery of this gene editing therapy, specifically by packaging it within the lentivirus:

“In terms of our uniqueness, we have safety patents on the lentivector platform out to 2023 and some manufacturing patents that go out to the end of the 2020s and into the 2030s.

At the moment, we are the only launched lentivector, and that makes it difficult to compare our lentivectors with others. What we can say is that we have spent 20 years’ experience developing these lentivectors, and they are quite difficult to produce, so we have a healthy amount of I.P. protection.”

To put it another way, the special Coca Cola formula that cures cancer that Novartis is producing is bottled in the Oxford Biomedica patented bottles, bottles that are especially difficult to make.

This company is also producing the bottles for many, many other drugs in development stage on the behalf of cutting edge biotechs seeking cures for a variety of particularly destructive diseases.

The unique technological expertise is touted by its management:

“…It shouldn’t be underestimated how important the analytics are postproduction to make sure that your lentivector is doing what it was designed to do.

We spend months postproduction doing analytical testing using FDA-approved quality systems to make sure that lentivector is doing everything that is required.

We cannot do the direct analytical comparisons, but in terms of know-how, we are confident we are a number of years ahead of our competition in terms of lenti manufacture, in terms of scale and quality.”

What will Brexit do to this 30 year old overnight success story in the making?

The collaboration for the current cancer cure is with a Swiss based company and is dependent on multiple national and international pharmaceutical approvals, probably the most complex scientific and legal process for businesses. But even before that, the company must negotiate with its partners for a royalty agreement that bind them to payouts if their research is eventually successful.

Oxford Biomedica is now in the somewhat enviable position of having demand side pressures to increase their capacity since this sector of genetic therapy is growing so quickly that labs that process even the small batches for research are in great demand.

Recent deals illustrate this demand. Thermo Fisher is paying $1.7 billion for the viral vector for gene therapy clinical trial producer Brammer Bio, and in February of 2019, Danaher agreed to pay $21 billion for General Electric’s biopharma business, a maker of equipment for biotech drug production.

So, this business sector is hot.

Oxford Biomedica is building their lab expansion now and is planning to more than double its capacity every year.

This requires sophisticated high end lab equipment sourced globally and sophisticated high end biologists also sourced globally.

Will Brexit cripple the company by limiting access to both equipment and talent?

It’s not as if the EU is a poster child for rational economic development. The creation of costly business regulations for the common market is through a voting process for elaborate legislation that often confuses its legislators into voting for the wrong regulation.

In the words of one European voting data collection agency:

“Because they have to vote on hundreds of items every week, MEPs sometimes forget to press the voting button, or press the wrong voting button. Sometimes the voting machines malfunction. When that happens they can enter a statement into the official record, the minutes, to the effect that they had intended to vote but didn’t or couldn’t, or that they had intended to vote differently.

However, this formal statement does not have the effect of altering their individual vote, and nor does it have an impact on the overall result. Once the President has announced the result of the vote it is final.”

As British politicians debate about how they plan to eat their own Brexit cooking, entrepreneurs are left with the compounding of risk. Will the laboratory equipment be held up at the port? Will scientists not be allowed to travel and work throughout the world?

To be sure, none of this is only a British problem but as committed investors funding this process we can only hope that scarce capital and scarce labor will be permitted to flow to its most productive outlet.

We can all only hope that the cure for cancer in children does not become a victim.

Kumaraguru Raja, Ph.D., MBA, is Vice President, Biotechnology Research at Noble Life Science Partners. Dr. Raja has significant experience as an Equity Analyst in the health care industry with a focus on biotechnology sector. Previously, he was an Senior Associate Analyst for over five years on the Citi Research biotechnology team that has been continuously ranked highly for biotechnology in the All-America Institutional Investor survey.

Dr. Raja’s expertise includes bottom-up scientific, financial analysis on companies across therapeutic areas and spectrum of market capitalizations. Dr. Raja has strong quantitative, scientific background with in-depth biotechnology and health care industry knowledge leveraged to identify compelling investment opportunities.

Dr. Raja conducted post-doctoral research at Mayo Clinic to understand the epigenetic causes of cancer and at Los Angeles Biomedical Research Institute to elucidate the molecular mechanisms concerning the role of human bone marrow stem cells in normal and leukemic hematopoiesis.

He received his Ph.D. in biological sciences from Bowling Green State University and MBA from University of California, San Diego. In his 2,010 word interview, exclusively with the Wall Street Transcript, Dr. Raja reviews his top biotech and gene therapy stock picks and details his rationale. One pick is on the cusp of having a key treatment approved.

“SCYNEXIS (NASDAQ:SCYX) is developing drugs for antifungal infections and conducting two Phase III trials in women with recurrent vulvovaginal candidiasis. Data is expected in 2020. It recently released data from the hospital setting on patients who do not respond to currently available antifungal treatments. They showed good response to SCYNEXIS’ drug ibrexafungerp. So this is an exciting company at about a $50 million market cap. Obviously, this will be a catalyst in 2020.”

In his exclusive 3,951 word interview in the Wall Street Transcript, Marco Taglietti, M.D., the President and Chief Executive Officer of SCYNEXIS, explains why this is only the first step for value creation for SCYX investors:

“An oral product is extremely critical because when patients start to recover in the hospital, we need to treat them and send these patients home for many reasons but, in part, to avoid contraction of hospital-based fungal infections.

For many cancer and transplant patients, a major risk factor is acquiring infections, unfortunately, so sending them back home is really a significant and important step in the management of these patients. However, you can send them home only if you have an oral product.

As I mentioned, the only product that is currently available orally are products belonging to the azole class, and they are becoming less and less effective. We believe our product will really be an important player in the future.”

Another top pick from Dr. Raja is the now super hot gene therapy sub-sector, RNA delivery platform technology:

“Arcturus Therapeutics (NASDAQ:ARCT) that is leveraging the mRNA delivery mechanism to treat various infectious diseases and orphan diseases. The preclinical data and overall technology are strong…The Big Pharma partners believe that the technology has some validation, so that is the reason for all these collaborations. It has collaborations with Johnson & Johnson (NYSE:JNJ), Takeda (NYSE:TAK) and Ultragenyx (NASDAQ:RARE) that are helping to fund development of a preclinical pipeline. ”

In his own exclusive 3,316 word interview with the Wall Street Transcript, the CEO of Arcturus, Joseph Payne, amplifies this investment thesis: “Arcturus’ OTC mRNA medicine will be one the first of its kind as a chronically dosed intravenous messenger RNA therapeutic. Why is that significant? Because it will begin to fill a large white space opportunity for intravenous messenger RNA that is enormous. We are excited to potentially be the first or one of the first ones to do so.”

Read all three of these in-depth exclusive interviews in the Wall Street Transcript, along with many more.

Steve Brozak is Managing Partner and President of WBB Securities, LLC. Dr. Brozak leads WBB Securities, LLC, an investment bank and financial analytical firm engaged in the pharmaceutical, biotechnology and medical device sectors. He has actively followed the evolving health care space over the last two decades and has written about and advised both health care companies and U.S. government agencies.

The Wall Street Journal named Dr. Brozak as the “Best on the Street” Financial Analyst for the medical equipment and supplies category in its 19th Annual Best on the Street survey. In 2013, Dr. Brozak was a top-ranked analyst in the pharmaceutical industry based on his 12-month performance returns by Thomson Reuters and StarMine, and is also a top-ranked biotech analyst.

Dr. Brozak is a retired lieutenant colonel in the United States Marine Corps and served on the Secretary of the Navy’s Navy and Marine Corps Retiree Council, where he focused on health care. Dr. Brozak holds a B.A. and MBA from Columbia University and his Doctorate in Medical Humanities — DMH — from Drew University.

In this exclusive 3,842 word interview in the Wall Street Transcript, Dr. Brozak explores current health care landscape and the economic implications for biotech stock investors.

“For the first time, you have true visibility and attention to prices and their proverbial values — something that we have never seen before. Everyone has always talked about this kind of focus, but we have never seen it. One aspect of this focus is the newly emerged examination of the pharmacy benefit manager — PBM — space, which has played an integral part in pharma and biotech.

This is something of a Pandora’s box. We have opened it, and the nascent steps to health care transparency are starting to be taken and with them the challenge to drug pricing and eventually even a quantification tied to patient outcomes.”

One result of this analysis is a top pick from Dr. Brozak:

“RedHill [RedHill Biopharma (NASDAQ:RDHL)],approach shuts down the causative agent of Crohn’s disease. RedHill has run clinical trials in which they have shown success in doing this.

Topline data from a recent Phase III study basically showed that an antibiotic combination therapy actually shut down Crohn’s in patients with statistically significant results.”

Get the full detail on this and many other picks from Dr. Brozak in the complete 3,842 word interview, only in the Wall Street Transcript.

Nancy Perez, CFA, is a Senior Portfolio Manager and Managing Director of Boston Private, a leading provider of fully integrated wealth management, trust and private banking services. She started her career about 30 years ago at Earl Foster Associates, which was a boutique RIA firm, and through subsequent mergers and acquisitions, it was purchased by Boston Private.

She currently manages two of the firm’s proprietary strategies: the dividend growth strategy and the quality growth strategy. She is also a member of the firm’s Asset Allocation and Investment Policy Committees. She graduated summa cum laude from the University of Miami.

In this exclusive 3,252 word interview in the Wall Street Transcript, Ms. Perez reviews her top picks and the diligent investing philosophy behind them:

“Royal Caribbean (NYSE:RCL), that’s one that we’ve held for a while. And I continue to think it’s one of the most attractive growth stocks at a reasonable price. It’s the second-largest operating cruise company with over 60 ships. And its brand is unique. It stands above its competitors, and it continues to drive repeat business. They continue to innovate their product lines and their ships.”

Another interesting favorite is Boeing:

“Boeing (NYSE:BA) generates over 30% return on invested capital, and they have very strong free cash flow growth. Air travel demand has been picking up as well, as some of the emerging markets have more spending power.

Given the duopoly between Airbus (OTCMKTS:EADSY), Boeing is the one that’s most leveraged to this global growth, particularly in air travel. It’s important to keep in mind, Boeing has seven years of backlog in commercial air, which should provide some stability going forward, particularly in these volatile markets.”

Get the complete picture on these picks, as well as many others in the complete 3,252 word interview with Nancy Perez of Boston Private, exclusively in the Wall Street Transcript.

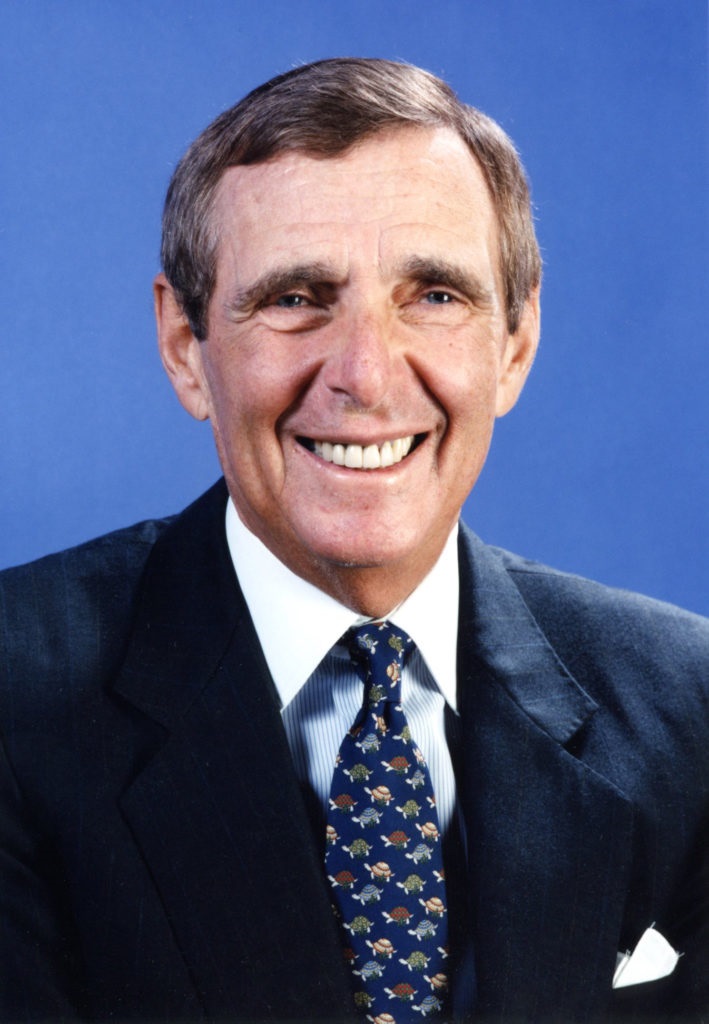

David Dreman is Chairman of Dreman Value Management, LLC. He has published many scholarly articles and has written five books. Mr. Dreman is on the board of directors of the Institute of Behavioral Finance. Earlier, he worked as Director of Research for Rauscher Pierce, Senior Investment Officer with J&W Seligman, and Senior Editor of the Value Line Investment Service.

He graduated from the University of Manitoba and took courses at Columbia University. He has spoken at a large number of CFA societies in the U.S. and abroad, as well at Harvard, the University of Chicago, the Wharton School, the University of California, Berkeley, and many other universities and national conferences on investments.

Mr. Dreman’s Kemper-Dreman High Return Fund was one of the best-performing mutual funds ever, ranking as the best of 255 funds in its peer groups from 1988 to 1998, according to Lipper Analytical Services. At the time, Mr. Dreman published Contrarian Investment Strategies: The Next Generation. In addition to managing money, Mr. Dreman is also a longtime Forbes magazine columnist.

In this exclusive 3,134 word interview in the Wall Street Transcript, Mr. Dreman picks his current favorites for investors and also details his forecast for the 2019 market and beyond.

“There are a number of sectors that are interesting. There are a lot of good companies in other industries that are really trading at price/earnings ratios that are very low. Oil is a more problematic area at the moment, but Phillips 66 (NYSE:PSX), a major oil refiner is one.

It was spun off at about $25 to Conoco (NYSE:COP) shareholders. It’s now at $96. And it’s trading at 11.2 times earnings, has a 3.33% yield and looks like it should continue to do well. It’s a solidly managed refinery, and we think there’s still a lot of potential there. If oil prices do move up, it will accelerate its current growth rate.

We also like the Canadian banks; most of them are listed on the New York Stock Exchange.”

Get all the Dreman contrarian picks by reading the entire 3,134 word interview, exclusively in the Wall Street Transcript.

Soumit Roy, Ph.D., is Vice President, Healthcare Analyst of Jones Trading Institutional Services LLC. Dr. Roy is responsible for research coverage on biotechnology companies within the healthcare sector for Jones Trading. Prior to joining Jones Trading in 2018, Dr. Roy was a senior research associate at SunTrust Robinson Humphrey, covering small- and mid-cap biotechnology companies with innovative technologies, notably T-cell therapy, targeted medicines, gene editing and next-generation immuno-oncology.

He was a postdoctoral fellow at the Icahn School of Medicine at Mount Sinai, New York, in the Clinical Immunology Department, and his research was focused on understanding and discovering novel agents to improve vaccines. He earned his Ph.D. from the Albert Einstein College of Medicine, New York, where he helped to develop a novel drug candidate that targets the powerhouse of cancer cells to stop cancerous growth.

In his 2,849 word interview exclusively in the Wall Street Transcript, Dr. Roy details his take on some upcoming results from clinical trials of oncology treatments:

“Deciphera’s Phase III top line reads out at ASCO, Mirati’s competitor Amgen will likely present clinical data on its KRAS inhibitor at ASCO and Mirati clinical data likely at ESMO, or European Society for Medical Oncology.

Scientists have been trying for the last two to three decades to come up with a targeted KRAS inhibitor, and it finally looks like Mirati and Amgen have cracked the code. Any positive updates from Amgen will likely be read as positive for Mirati.”

The outlook for advanced oncology treatments is positive:

“What has happened in the last three, four or five years is a whole flood of cancer patient genome has gotten profiled, based on different lines of therapy and therapeutic agents. Bristol-Myers Squibb (NYSE:BMY) has done a great job in looking at these genetic profiles.”

Get the complete list of biotech upstarts that are testing their cancer treatments right now with outcomes by year end by reading the entire 2,849 word interview exclusively in the Wall Street Transcript.

Joseph E. Payne is the President and Chief Executive Officer of Arcturus Therapeutics Ltd. and has served on Arcturus’ board since March 2013. He brings to that position an exceptional track record of ushering novel therapeutics into the clinic, including targeted RNA medicines that utilize lipid-mediated delivery technologies.

Mr. Payne’s background includes over 20 years of successful drug discovery experience at Merck Research Labs, DuPont Pharmaceuticals, Bristol-Myers Squibb, Kalypsys and Nitto as evidenced by over 40 publications and patents, and several investigational new drug — IND — clinical candidates.

His academic training includes a bachelor’s degree in chemistry, magna cum laude from Brigham Young University, a Master of Science in synthetic organic chemistry from the University of Calgary and Executive Training Certification from MIT Sloan School of Management.

In this 3,316 word interview exclusively in the Wall Street Transcript, Mr. Payne details the strategy road map for Arcturus and the key sustainable competitive advantage for his company.

“The RNA companies that describe themselves as antisense RNA or RNAi or siRNA or microRNA companies are using small RNA, as in small molecules. There are other methods to deliver those types of RNA, but large RNA is much more challenging. Very few players can functionally, effectively and safely deliver large RNA, and we are fortunate to be one of these companies.

Our LUNAR platform technology is a nonviral, lipid-mediated delivery system that allows for multidosing, attenuating and flexible delivery.”

The company has some impressive partnerships:

“For example, hepatitis B with J&J represents an enormous market of 300 million patients, so that is a J&J-type disease. NASH — nonalcoholic steatohepatitis — is the number-one liver disease, and Takeda is the number-one Japanese pharma company that also happens to be a world leader in NASH and fibrotic disease, so we partnered our technology with Takeda.”

Get the complete picture of this fascinating company and the entire detail by reading the 3,316 word interview in the Wall Street Transcript.

Yun Zhong, Ph.D., is Equity Research Analyst and Director of Biotechnology Research at Janney Montgomery Scott LLC. Dr. Zhong joined Janney in 2017 with over seven years of experience as an associate covering the biotechnology industry. He has experience in several therapeutic areas including gene therapy, rare diseases, central nervous system disorders, infectious diseases, hepatobiliary disorders, among others.

Prior to Janney, Dr. Zhong spent over three years at SunTrust Robinson Humphrey, where he covered several companies while working within their health care/biotechnology vertical. From 2011 to 2014, he worked as a biotechnology equity research associate at Cowen and Company.

Prior to Cowen, he worked as a postdoctoral fellow in the Department of Neurology at Mount Sinai School of Medicine. Dr. Zhong received his Ph.D. in neuroscience and molecular biology from the Rockefeller University and both his M.S. and B.S. degrees in biophysical engineering from Osaka University in Japan.

In this 3,466 word interview in the Wall Street Transcript, includes a complete review of the potential of cutting edge biotech companies and has specific recommendations for investors

Dr. Zhong sees an M&A cycle occurring in the gene therapy space:

“The acquisition price is $114.50. That is about 120% premium as compared to the closing price on Friday for Spark (NASDAQ:ONCE). That, of course, is a huge positive for not only Spark’s stock price, but if you look at other gene therapy names across the board, we are seeing a lot of upward movement.”

The establishment of a bidding multiple has significant implications:

“The premium is very much in line with what we have seen in the past, for example, from the previous acquisition deal, which was also a gene therapy name, from back in April 2018 when Novartis (NYSE:NVS) acquired AveXis. That premium was about 88%, so also close to 100%. The 100% premium is probably the standard that we would expect from these kinds of acquisition deals.”

This trend is expected to continue:

“Large-cap biotech companies are also active players in acquisition. For example, Celgene (NASDAQ:CELG) did multiple acquisitions, including Juno Therapeutics, a cell therapy company, before Bristol-Myers Squibb (NYSE:BMY) announced a plan to acquire Celgene in January. What we have heard from industry people suggests to us that large-cap biotech companies as well as major pharma companies are really getting increasingly comfortable with gene therapy. So we definitely expect similar deals to occur.”

To get Dr. Zhong’s complete list of targets, read the entire 3,466 word interview in the Wall Street Transcript.

Raju Prasad, Ph.D., is Analyst at William Blair & Company, L.L.C. Dr. Prasad is a biotechnology analyst who is focused on therapeutics and joined William Blair in March 2014. Dr. Prasad previously worked as a research associate with the University of North Carolina at Chapel Hill’s Gillings School of Global Public Health and as an independent consultant with the U.S. Environmental Protection Agency.

Dr. Prasad has a B.A. in cell biology and neuroscience from Rutgers University, an M.S. in exercise physiology from the University of Delaware and a Ph.D. in environmental sciences and engineering from the University of North Carolina at Chapel Hill with a focus in genetic toxicology and mutagenesis.

In this exclusive 3,000 word interview in the Wall Street Transcript, Dr. Prasad reviews the gene therapy sector with some specific recommendations for investors:

“It is going to be a big year for gene and cell therapy, particularly for commercialization. Three products have been approved and launched already: Spark’s (NASDAQ:ONCE) Luxturna, Gilead’s (NASDAQ:GILD) Yescarta and Novartis’ (NYSE:NVS) Kymriah.

In 2019, you will have bluebird’s (NASDAQ:BLUE) LentiGlobin potentially being commercialized in the EMA — European Medicines Agency — pending approval, which is expected sometime in the near term. Then, you also have potentially Novartis’ Zolgensma, which should potentially be approved midyear. I covered AveXis as well prior to its acquisition but do not cover Novartis.

So it will be a big year as far as realizing the real-world pros and cons of next-generation cell and gene therapy commercialization. ”

One recommendation in the volatile space is considered a buying opportunity by Dr. Prasad:

“Then, you’ll have companies for which, just based on a snapshot of the data, there will be an outsized selloff.

Spark, in 2017, was a perfect example of that. You had two patients’ worth of data in August that showed 11% and 14% respectively at factor level, and the stock shot up 25% to 30%.

The next data update at ASH was on five patients’ worth of data, and they weren’t seeing a dose response, and there was some immune reaction with the patients that were disclosed, and you had a 50% down move. Wide swings in valuations potentially create overvaluation, or it could potentially create undervaluation and buying opportunities. Right now, in my opinion, Spark is in an undervalued position going into their hemophilia data at midyear.”

Get all the detail on this and many other recommendations in the 3,000 word interview, exclusively in the Wall Street Transcript.

Darcy Bomford is Founder, Chief Executive Officer and Director of True Leaf Medicine International Ltd. Mr. Bomford is a pet industry veteran with three decades of experience in manufacturing, branding, distribution and sales. He exited the pet industry in 2012 and formed True Leaf Medicine with the intent to become a licensed producer of cannabis under Canada’s medicinal cannabis program.

The company now has two divisions, True Leaf Pet and True Leaf Medicine. He is highly adept at building brands through corporate vision, strategy and the successful development of relationships with team members and strategic partners.

In this 2,791 word interview exclusive to the Wall Street Transcript, Mr. Bomford details his road map for his innovative product line.

“Our product line right now is primarily made up of hemp-based supplements for pets. Dogs represent the largest piece of the market, but we have a cat line in Europe, which we also plan to bring to North America. Currently, the product line is targeted at three different pet health challenges: calming support, hip and joint support for older dogs with inflammation issues, and omega-3 support for immune and cognitive support.

We sell these supplements in three formats: soft chews, oils and chew sticks. Calming is our biggest seller, which shows that our pets are anxious from our busy world just like humans are.”

The CEO is emphatic on the benefits:

“The primary function of the hemp seed product is providing the omega-3 components, and yes, they are validated by scientific research. Omega-3s are known to be very healthy and good for people and pets, which in this case is the primary function of the hemp seed.

Our future hemp leaf formulas will contain naturally occurring cannabinoids, such as CBD, CBDA, CBN and CBG. These higher-strength products will also include other proprietary active ingredients to work synergistically with hemp — just like our current formulas.”

Read the entire 2,791 word interview exclusively in the Wall Street Transcript and get the complete detail.