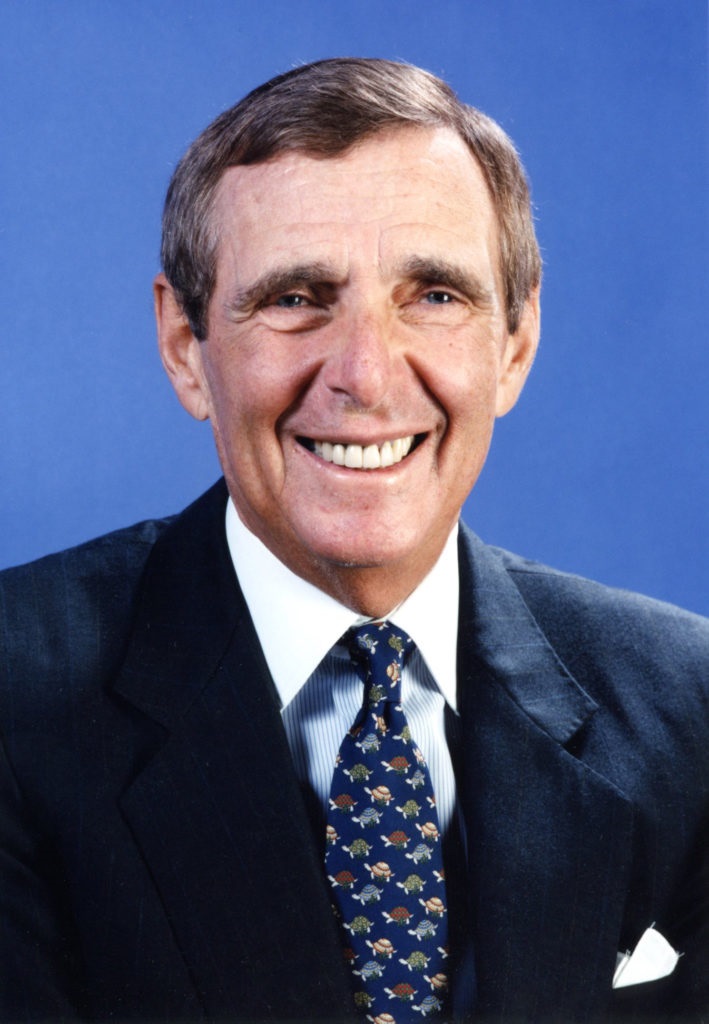

David Dreman is Chairman of Dreman Value Management, LLC. He has published many scholarly articles and has written five books. Mr. Dreman is on the board of directors of the Institute of Behavioral Finance. Earlier, he worked as Director of Research for Rauscher Pierce, Senior Investment Officer with J&W Seligman, and Senior Editor of the Value Line Investment Service.

He graduated from the University of Manitoba and took courses at Columbia University. He has spoken at a large number of CFA societies in the U.S. and abroad, as well at Harvard, the University of Chicago, the Wharton School, the University of California, Berkeley, and many other universities and national conferences on investments.

Mr. Dreman’s Kemper-Dreman High Return Fund was one of the best-performing mutual funds ever, ranking as the best of 255 funds in its peer groups from 1988 to 1998, according to Lipper Analytical Services. At the time, Mr. Dreman published Contrarian Investment Strategies: The Next Generation. In addition to managing money, Mr. Dreman is also a longtime Forbes magazine columnist.

In this exclusive 3,134 word interview in the Wall Street Transcript, Mr. Dreman picks his current favorites for investors and also details his forecast for the 2019 market and beyond.

“There are a number of sectors that are interesting. There are a lot of good companies in other industries that are really trading at price/earnings ratios that are very low. Oil is a more problematic area at the moment, but Phillips 66 (NYSE:PSX), a major oil refiner is one.

It was spun off at about $25 to Conoco (NYSE:COP) shareholders. It’s now at $96. And it’s trading at 11.2 times earnings, has a 3.33% yield and looks like it should continue to do well. It’s a solidly managed refinery, and we think there’s still a lot of potential there. If oil prices do move up, it will accelerate its current growth rate.

We also like the Canadian banks; most of them are listed on the New York Stock Exchange.”

Get all the Dreman contrarian picks by reading the entire 3,134 word interview, exclusively in the Wall Street Transcript.

Soumit Roy, Ph.D., is Vice President, Healthcare Analyst of Jones Trading Institutional Services LLC. Dr. Roy is responsible for research coverage on biotechnology companies within the healthcare sector for Jones Trading. Prior to joining Jones Trading in 2018, Dr. Roy was a senior research associate at SunTrust Robinson Humphrey, covering small- and mid-cap biotechnology companies with innovative technologies, notably T-cell therapy, targeted medicines, gene editing and next-generation immuno-oncology.

He was a postdoctoral fellow at the Icahn School of Medicine at Mount Sinai, New York, in the Clinical Immunology Department, and his research was focused on understanding and discovering novel agents to improve vaccines. He earned his Ph.D. from the Albert Einstein College of Medicine, New York, where he helped to develop a novel drug candidate that targets the powerhouse of cancer cells to stop cancerous growth.

In his 2,849 word interview exclusively in the Wall Street Transcript, Dr. Roy details his take on some upcoming results from clinical trials of oncology treatments:

“Deciphera’s Phase III top line reads out at ASCO, Mirati’s competitor Amgen will likely present clinical data on its KRAS inhibitor at ASCO and Mirati clinical data likely at ESMO, or European Society for Medical Oncology.

Scientists have been trying for the last two to three decades to come up with a targeted KRAS inhibitor, and it finally looks like Mirati and Amgen have cracked the code. Any positive updates from Amgen will likely be read as positive for Mirati.”

The outlook for advanced oncology treatments is positive:

“What has happened in the last three, four or five years is a whole flood of cancer patient genome has gotten profiled, based on different lines of therapy and therapeutic agents. Bristol-Myers Squibb (NYSE:BMY) has done a great job in looking at these genetic profiles.”

Get the complete list of biotech upstarts that are testing their cancer treatments right now with outcomes by year end by reading the entire 2,849 word interview exclusively in the Wall Street Transcript.

Joseph E. Payne is the President and Chief Executive Officer of Arcturus Therapeutics Ltd. and has served on Arcturus’ board since March 2013. He brings to that position an exceptional track record of ushering novel therapeutics into the clinic, including targeted RNA medicines that utilize lipid-mediated delivery technologies.

Mr. Payne’s background includes over 20 years of successful drug discovery experience at Merck Research Labs, DuPont Pharmaceuticals, Bristol-Myers Squibb, Kalypsys and Nitto as evidenced by over 40 publications and patents, and several investigational new drug — IND — clinical candidates.

His academic training includes a bachelor’s degree in chemistry, magna cum laude from Brigham Young University, a Master of Science in synthetic organic chemistry from the University of Calgary and Executive Training Certification from MIT Sloan School of Management.

In this 3,316 word interview exclusively in the Wall Street Transcript, Mr. Payne details the strategy road map for Arcturus and the key sustainable competitive advantage for his company.

“The RNA companies that describe themselves as antisense RNA or RNAi or siRNA or microRNA companies are using small RNA, as in small molecules. There are other methods to deliver those types of RNA, but large RNA is much more challenging. Very few players can functionally, effectively and safely deliver large RNA, and we are fortunate to be one of these companies.

Our LUNAR platform technology is a nonviral, lipid-mediated delivery system that allows for multidosing, attenuating and flexible delivery.”

The company has some impressive partnerships:

“For example, hepatitis B with J&J represents an enormous market of 300 million patients, so that is a J&J-type disease. NASH — nonalcoholic steatohepatitis — is the number-one liver disease, and Takeda is the number-one Japanese pharma company that also happens to be a world leader in NASH and fibrotic disease, so we partnered our technology with Takeda.”

Get the complete picture of this fascinating company and the entire detail by reading the 3,316 word interview in the Wall Street Transcript.

Yun Zhong, Ph.D., is Equity Research Analyst and Director of Biotechnology Research at Janney Montgomery Scott LLC. Dr. Zhong joined Janney in 2017 with over seven years of experience as an associate covering the biotechnology industry. He has experience in several therapeutic areas including gene therapy, rare diseases, central nervous system disorders, infectious diseases, hepatobiliary disorders, among others.

Prior to Janney, Dr. Zhong spent over three years at SunTrust Robinson Humphrey, where he covered several companies while working within their health care/biotechnology vertical. From 2011 to 2014, he worked as a biotechnology equity research associate at Cowen and Company.

Prior to Cowen, he worked as a postdoctoral fellow in the Department of Neurology at Mount Sinai School of Medicine. Dr. Zhong received his Ph.D. in neuroscience and molecular biology from the Rockefeller University and both his M.S. and B.S. degrees in biophysical engineering from Osaka University in Japan.

In this 3,466 word interview in the Wall Street Transcript, includes a complete review of the potential of cutting edge biotech companies and has specific recommendations for investors

Dr. Zhong sees an M&A cycle occurring in the gene therapy space:

“The acquisition price is $114.50. That is about 120% premium as compared to the closing price on Friday for Spark (NASDAQ:ONCE). That, of course, is a huge positive for not only Spark’s stock price, but if you look at other gene therapy names across the board, we are seeing a lot of upward movement.”

The establishment of a bidding multiple has significant implications:

“The premium is very much in line with what we have seen in the past, for example, from the previous acquisition deal, which was also a gene therapy name, from back in April 2018 when Novartis (NYSE:NVS) acquired AveXis. That premium was about 88%, so also close to 100%. The 100% premium is probably the standard that we would expect from these kinds of acquisition deals.”

This trend is expected to continue:

“Large-cap biotech companies are also active players in acquisition. For example, Celgene (NASDAQ:CELG) did multiple acquisitions, including Juno Therapeutics, a cell therapy company, before Bristol-Myers Squibb (NYSE:BMY) announced a plan to acquire Celgene in January. What we have heard from industry people suggests to us that large-cap biotech companies as well as major pharma companies are really getting increasingly comfortable with gene therapy. So we definitely expect similar deals to occur.”

To get Dr. Zhong’s complete list of targets, read the entire 3,466 word interview in the Wall Street Transcript.

Raju Prasad, Ph.D., is Analyst at William Blair & Company, L.L.C. Dr. Prasad is a biotechnology analyst who is focused on therapeutics and joined William Blair in March 2014. Dr. Prasad previously worked as a research associate with the University of North Carolina at Chapel Hill’s Gillings School of Global Public Health and as an independent consultant with the U.S. Environmental Protection Agency.

Dr. Prasad has a B.A. in cell biology and neuroscience from Rutgers University, an M.S. in exercise physiology from the University of Delaware and a Ph.D. in environmental sciences and engineering from the University of North Carolina at Chapel Hill with a focus in genetic toxicology and mutagenesis.

In this exclusive 3,000 word interview in the Wall Street Transcript, Dr. Prasad reviews the gene therapy sector with some specific recommendations for investors:

“It is going to be a big year for gene and cell therapy, particularly for commercialization. Three products have been approved and launched already: Spark’s (NASDAQ:ONCE) Luxturna, Gilead’s (NASDAQ:GILD) Yescarta and Novartis’ (NYSE:NVS) Kymriah.

In 2019, you will have bluebird’s (NASDAQ:BLUE) LentiGlobin potentially being commercialized in the EMA — European Medicines Agency — pending approval, which is expected sometime in the near term. Then, you also have potentially Novartis’ Zolgensma, which should potentially be approved midyear. I covered AveXis as well prior to its acquisition but do not cover Novartis.

So it will be a big year as far as realizing the real-world pros and cons of next-generation cell and gene therapy commercialization. ”

One recommendation in the volatile space is considered a buying opportunity by Dr. Prasad:

“Then, you’ll have companies for which, just based on a snapshot of the data, there will be an outsized selloff.

Spark, in 2017, was a perfect example of that. You had two patients’ worth of data in August that showed 11% and 14% respectively at factor level, and the stock shot up 25% to 30%.

The next data update at ASH was on five patients’ worth of data, and they weren’t seeing a dose response, and there was some immune reaction with the patients that were disclosed, and you had a 50% down move. Wide swings in valuations potentially create overvaluation, or it could potentially create undervaluation and buying opportunities. Right now, in my opinion, Spark is in an undervalued position going into their hemophilia data at midyear.”

Get all the detail on this and many other recommendations in the 3,000 word interview, exclusively in the Wall Street Transcript.

Darcy Bomford is Founder, Chief Executive Officer and Director of True Leaf Medicine International Ltd. Mr. Bomford is a pet industry veteran with three decades of experience in manufacturing, branding, distribution and sales. He exited the pet industry in 2012 and formed True Leaf Medicine with the intent to become a licensed producer of cannabis under Canada’s medicinal cannabis program.

The company now has two divisions, True Leaf Pet and True Leaf Medicine. He is highly adept at building brands through corporate vision, strategy and the successful development of relationships with team members and strategic partners.

In this 2,791 word interview exclusive to the Wall Street Transcript, Mr. Bomford details his road map for his innovative product line.

“Our product line right now is primarily made up of hemp-based supplements for pets. Dogs represent the largest piece of the market, but we have a cat line in Europe, which we also plan to bring to North America. Currently, the product line is targeted at three different pet health challenges: calming support, hip and joint support for older dogs with inflammation issues, and omega-3 support for immune and cognitive support.

We sell these supplements in three formats: soft chews, oils and chew sticks. Calming is our biggest seller, which shows that our pets are anxious from our busy world just like humans are.”

The CEO is emphatic on the benefits:

“The primary function of the hemp seed product is providing the omega-3 components, and yes, they are validated by scientific research. Omega-3s are known to be very healthy and good for people and pets, which in this case is the primary function of the hemp seed.

Our future hemp leaf formulas will contain naturally occurring cannabinoids, such as CBD, CBDA, CBN and CBG. These higher-strength products will also include other proprietary active ingredients to work synergistically with hemp — just like our current formulas.”

Read the entire 2,791 word interview exclusively in the Wall Street Transcript and get the complete detail.

Dinesh V. Patel, Ph.D., is Director, President and CEO of Protagonist Therapeutics, Inc. Dr. Patel has served as a member of the board of directors and as the President and Chief Executive Officer of Protagonist since December 2008. He has 33 years of executive, entrepreneurial and scientific experience that span the pharmaceutical, biotechnology and biopharmaceutical industries.

Prior to joining Protagonist Therapeutics, Dr. Patel served from 2006 to 2008 as the President and Chief Executive Officer of Arete Therapeutics, a privately held company focused on novel drugs for metabolic syndrome. Previously, he was the Chief Executive Officer and Co-Founder of Miikana Therapeutics, an oncology-based company, from 2003 until acquired by Entremed — later renamed CASI Pharmaceuticals — in 2005. Prior to Miikana, Dr. Patel was a founding member at Versicor — now Vicuron — where he held positions of increasing responsibility from 1996 to 2003.

Vicuron has two marketed drugs, anidulafungin, or Eraxis, and dalbavancin, or Dalvance, and it was acquired by Pfizer in 2005 in a $1.9 billion cash transaction. From 1993 to 1996, Dr. Patel was a director of chemistry at the combinatorial chemistry company Affymax.

Dr. Patel was a medicinal chemist at Bristol-Myers Squibb from 1985 to 1993. Dr. Patel received his Ph.D. in chemistry from Rutgers University, New Jersey and his B.S. in industrial chemistry from S. P. University, Vallabh Vidyanagar, India.

In this exclusive 2,554 word interview in the Wall Street Transcript, Dr. Patel details his road map for his company Protaganist Therapeutics.

“The second category is represented by PTG-200 and PN-943, which are oral drugs for inflammatory bowel disease — IBD. The oral delivery method is the first difference in comparison to PTG-300. Also, while PTG-300 was an agonist or a mimetic, these are antagonists.

The third difference is, while PTG-300 is focused on rare diseases, PTG-200 and PTG-943 are focused on inflammatory bowel diseases, which affect many patients worldwide.

When you look at IBD, the prominent products are Humira, Remicade and Stelara, all of which are multibillion-dollar blockbuster drugs. These are top-selling drugs of modern times. Protagonist is going after the same biological mechanisms that have been validated by these multibillion-dollar injectable antibodies; however, our uniqueness is that our drugs are oral.”

Get the complete picture of the status of these important medical developments by reading the entire 2,554 word interview, exclusively in the Wall Street Transcript.

Steven Seedhouse, Ph.D., is Vice President, Equity Research, Biotechnology at Raymond James Financial, Inc. Dr. Seedhouse has been a biotech equity research analyst or an associate at various firms since 2015.

He joined Raymond James in March 2018. Prior to his career in equity research, Dr. Seedhouse completed a Ph.D. in pharmacology from Roswell Park Cancer Institute in Buffalo, New York, and holds an M.S. in medicinal chemistry from SUNY Buffalo.

In this 3,701 word interview exclusively for the Wall Street Transcript, Dr, Seedhouse looks through the current leaders in the biotech sector and picks his favorites:

“The timing of this interview for NASH is particularly good because the first-ever Phase III studies in non-cirrhotic patients are coming in the next few months. The first one will be Intercept (NASDAQ:ICPT) and the REGENERATE study reading out in the first quarter, and then Gilead has a trial called STELLAR-3 reading out in the second quarter.

Gilead also has a trial in F4 cirrhotic NASH patients reading out in the first quarter as well. There are other additional Phase II data sets and potentially another Phase III data set from Genfit (OTCMKTS:GNFTF) later in the year as well. This is a data-rich year.

It is going to be exciting, if those trials work, to see what happens from a regulatory standpoint and also from an M&A standpoint in the NASH base. Speaking with investors, I think, it is widely expected that the outcome of the Intercept study will be positive.

People are tending to be more skeptical of Gilead’s Phase III studies, but there is a high likelihood of Intercept’s work. I do think there is a chance that Gilead works, but it’s a little bit more of a coin flip. We will see.

NASH is a market that’s going to be here to stay.”

To get all the other top picks from Dr. Seedhouse, read the entire 3,701 word interview exclusively in the Wall Street Transcript.

Seth Lederman, M.D., is Co-Founder, CEO and Chairman of Tonix Pharmaceuticals Holding Corp. Dr. Lederman is a physician, scientist, founder and executive officer of innovative biopharmaceuticals companies. Prior to founding Tonix, among the companies Dr. Lederman founded was Targent Pharmaceuticals, which developed late-stage oncology drugs, including pure-isomer levofolinic acid — levoleucovorin.

Targent’s assets were sold to Spectrum Pharmaceuticals, which marketed levoleucovorin as Fusilev for advanced colorectal cancer, where it gained significant market acceptance. Dr. Lederman served as an Associate Professor at Columbia University from 1996 until April 13, 2017.

He joined the faculty of Columbia University’s College of Physicians and Surgeons in 1985, became Assistant Professor of Medicine in 1988 and Associate Professor with tenure in 1996 and Director of the Laboratory of Molecular Immunology in 1997. From 1988 to 2002, Dr. Lederman directed basic science research at Columbia in molecular immunology, infectious diseases and the development of therapeutics for autoimmune diseases.

In this 5,394 word interview, Dr. Lederman explains his company’s primary drug developement:

“The indication that we are seeking is for “the treatment of PTSD,” and that label will not be restricted to PTSD from trauma in either military or civilian life. With all the military treatment data we have collected, we are now turning toward a study that is a mixture of PTSD from civilian or military trauma. ”

The initial target market is a high profile segment of our society:

“When sertraline or other SSRI antidepressants have been studied for military PTSD, they have not performed well. That is why we believe that our product, with the provisional trade name of Tonmya, or the internal code of TNX-102 SL, is so exciting and potentially differentiated. The results of our two studies in military-related PTSD indicate that TNX-102 SL shows activity in people with military-related PTSD.”

Get the full detail on the status of the development of this important new drug by reading the entire 5,394 word interview in the Wall Street Transcript.

Thomas Meyer is Chief Executive Officer of Auris Medical Holding AG. Dr. Meyer founded Auris Medical in April 2003 and was the sole shareholder until the end of 2007. Prior to founding Auris Medical, he was the Chief Executive Officer of Disetronic Group, a leading Swiss supplier of precision infusion and injection systems.

He worked for Disetronic in various functions starting in 1988, becoming member of the board of directors in 1996, Deputy Chief Executive Officer in 1999 and Chief Executive Officer in early 2000. Prior to joining Disetronic, he advised several Swiss companies in strategy, marketing and corporate finance.

Hernan Levett is Chief Financial Officer of Auris Medical Holding AG. Mr. Levett, CPA, has served as Auris Medical’s Chief Financial Officer since January 2017.

Prior to joining Auris Medical, Mr. Levett served as Head of Group Controlling at Acino Pharma AG and previously served as Vice President of Finance and Administration Europe at InterMune International AG. In addition, he spent 10 years at Novartis, most recently as Chief Financial Officer of Novartis Chile SA.

In this 2,933 word interview, the two executives detail the current status of their biopharmaceutical company and describe the next steps for investors. Dr. Meyer is still very bullish about his tinnitus treatment:

“Dr. Meyer: In tinnitus, the unmet medical need is really very, very strong because some people suffer a lot — well, we keep receiving from all over the world inquiries about the drug. At the same time, tinnitus is challenging because it’s not directly measurable, and in Phase III, we faced challenges with the way the tinnitus was measured. ”

Mr. Levett is satisfied with the company’s current capitalization:

“Mr. Levett: The company closed Q3 with 5.3 million Swiss francs in cash and cash equivalents. Since then, we have been active and raising capital. Following the offering we did in July 2018, we had warrants that were also exercised and brought additional cash during Q4 to us.

In addition, we had new investors taking a position in the company. We also are equipped with two additional programs. One is an equity line with Lincoln Park Capital. Another one is an ATM — at-the-market — facility with Alliance Global Partners. So with that, we are in good shape.”

Read the entire 2,933 word interview in the Wall Street Transcript and get clarity about the near term prospects for Auris Medical from these two senior executives.